Want to get your hands on the sleek and smart Apple Card? It’s critical to understand the credit score requirements before applying.

In this post, we’ll look at the credit score you’ll need to qualify and offer some advice on how to enhance your chances of approval.

Apple Card Overview

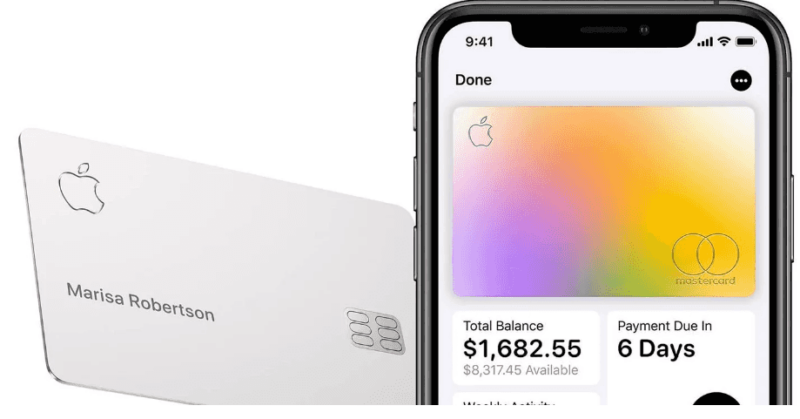

Apple card is a credit card issued by Goldman Sachs designed for Apple users. It’s a sleek and innovative card designed to integrate seamlessly with your Apple devices.

You can apply for an Apple Card through the Wallet App on your iPhone and once approved, you can start using it immediately through Apple Pay. It’s a “no annual fee credit card” and you won’t be charged common credit cards fees such as foreign transaction fees, cash advance fees, over-limit fees, and late fees.

Its integration with the Wallet App gives you access to unique features designed for privacy and security making it a great choice for building credit while collecting cash-back rewards.

What Credit Score Do You Need for an Apple Card?

Goldman Sachs uses the FICO score 9 model which ranges from 300 to 850. Scores above 660 are considered favorable for credit approval. However, other factors are considered by the issuer before making a decision for an Apple Card application.

Here are the following conditions that might cause Goldman Sachs to decline your application:

- If you’re currently or have been recently past due on your debt obligations.

- If you have negative public records.

- If your income is insufficient to make debt payments.

- If you frequently apply for credit cards or loans.

In case your initial application is declined, you can get an invitation for the Path to Apple Card Program that provides steps to improve your financial health and get approved for Apple Card in the future.

Once approved, your Apple Card credit limit is assigned by Goldman Sachs based on a number of factors such as your credit score, your income, the minimum payments associated with your existing debts, and your existing credits.

How to Get Preapproved for an Apple Card?

You can use Apple Card’s preapproval tool to get a solid idea of your chances of approval before an actual application. A soft credit check will be performed in just a few minutes with no impact on your credit score.

As you already know, proceeding with the application means going through a hard credit inquiry that will hurt your credit score, but only for a bit

Keep in mind that preapproval doesn’t guarantee actual approval. A soft credit inquiry can only give a snapshot of your credit status for a specific day and time with the help of the preliminary information that you provided. But there is nothing to lose, so it’s still worth a try.

Final Thoughts

Apple Card is a big plus for Apple users and for those who are excited about utilizing mobile wallets. It offers an innovative integration of a mobile app user interface and a physical card–-a titanium card which is also good-looking.

The average FICO score in the US was 714 in 2022. This makes the Apple Card credit score requires a reasonable standard making it widely available for most people. A good starter option for anyone who is new to credit.

FAQs

Is Apple Card a good beginner card?

It is good, but not the best. Though a 660 FICO score is below the national average, it still means that those with lower than 600 scores are unlikely to be approved. There are plenty of better first-time credit cards on the market.

How much minimum income is required for an Apple Card?

There is no minimum income limit required. Your income is in part being used to determine your initial credit limit, and/or to check if you can pay other existing debts. If it all adds up whatever your income is, there should be no problem.

Is Apple Card good for building credit?

Yes, and it makes the most sense if you’re already using Apple Pay frequently. With zero fee and cash back options, Apple Card can help build your credit plus a lot of savings.