A credit score of 700 is considered good by most banks, credit bureaus, and lenders. It is a respectable score demonstrating the borrower’s ability to manage their finances.

This article will discuss the benefits of a 700 credit score, how to build and maintain it, and what it can get you. Moreover, we’ll also be answering some frequently asked questions.

The Benefits Of A 700 Credit Score

The advantages of a 700 credit score include:

- Lower Interest Rates – A good credit score can save you significant money on interest rates. Consequently, making big financial choices will be much easier.

- Easier Loan Approval – A credit score of 700 makes you an attractive candidate to lenders. Taking out loans and getting approved for a credit card will be easier for you.

- Be Approved For Rentals – Many landlords and property management companies run a credit check on rental applicants. A good credit score will improve your chances of getting approved for your desired property, especially in competitive markets.

- Lower Insurance Premiums – Insurance companies use credit scores to determine car and home insurance premiums. Hence, a good credit score of 700 will allow you to secure lower premiums and save money on insurance.

What Can A 700 Credit Score Get You?

If your credit score is credit score is 700, you have higher chances of availing of the following financial services:

- Personal Loans – A personal loan is an unsecured loan that can be used for any kind of purpose. With a 700 credit score, you may qualify for a personal loan with competitive interest rates and favorable terms.

- Auto Loans – If you want a new car, a 700 credit score can help you qualify for an auto loan with favorable terms.

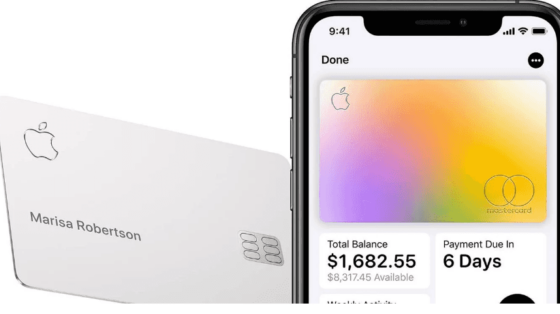

- Credit Cards – Having a credit score of 700 qualifies you for various credit cards. You can use these to buy items on installment bases and earn points to claim rewards.

- Home Loans – You may need extra funds to buy your dream home. Luckily, a 700 credit score helps you qualify for a mortgage with low interest and a downpayment.

- Business Loans – Small business owners with a 700 credit score can take out a business loan with favorable terms and a higher borrowing limit.

Building and maintaining a 700 credit score is easy if you’re determined. But what can you get with such a credit score? Let’s find out together in the next section.

How To Build/Maintain A 700 Credit Score

In order to keep your credit score above 700, you need to practice responsible credit management and develop sound financial routines. Here are helpful tips:

- Pay Bills On Time – One of the most important determining factors of your credit score is your payment history. Make it a point to pay your bills on time, as late payments can significantly negatively impact your credit report.

- Minimize Credit Utilization – Credit utilization refers to the credit you’re using compared to your credit limit. To have a 700 credit score, you must keep your credit utilization beneath 30% of your total credit limit except when absolutely necessary.

- Don’t Close Old Credit Cards – The length of your credit history is another factor in determining your credit score. Closing old credit cards can reduce the average age of your accounts, which can hurt your credit score.

- Monitor Your Credit Report – Regularly check your credit report to ensure all the information is accurate. Why? Inaccurate information can lower your credit score and harm your chances of securing loans or credit cards in the near future.

The Takeaway

A 700 credit score is a good credit score that can provide many benefits. Examples include easy loan approvals, low-interest rates, and better credit card offers.

Reaching and maintaining a 700 credit score requires you to be responsible. By adhering to the right practices, you can improve your credit score of the perks that come with it.

FAQs

1. What Is Considered A Good Credit Score?

Generally speaking, most banks consider a credit score of 700 and above a good credit score.

With that said, credit scores range between 850 and what is considered a good score varies depending on the lender, credit bureau, or bank.

2. How Long Does It Take To Achieve A 700 Credit Score?

The time it takes to reach a 700 credit score depends on your financial history and behavior. On average, it can take 6 months to a year of responsible financial behavior to achieve a 700 credit score.

3. Can You Quickly Improve Your Credit Score?

Improving your credit score is a gradual process that requires long-term responsible financial behavior. There are no shortcuts to improving your credit score quickly. However, you can take steps to avoid activities that can harm your score.