With more and more online payment options available every day, checks may seem outdated to younger generations. However, they are still being used, so knowing how to read a check will probably come in handy one day when you need to cash one, make a payment, or void a check.

So, regardless of their current lack of popularity, keep reading to learn about everything you can see on a check.

When to Use a Check

You can use a check to provide information about your bank account. For example, if you want to set up automatic payments of your bills or direct deposit, you would need the information from your check. Even if you just need to void a check and give it to somebody, reading a check correctly is a must.

Some people may use checks just because they prefer the simplicity and reliability that checks provide. For example, they are much more secure than cash, as losing a checkbook does not automatically mean losing all your money. If you lost a wallet with cash, on the other hand, there wouldn’t be much you could do.

Of course, the drawback would be that the person finding your lost check would have all your information. This is why safety is always advised, regardless of how you store and use your money.

Breakdown of a Check: All Parts Explained

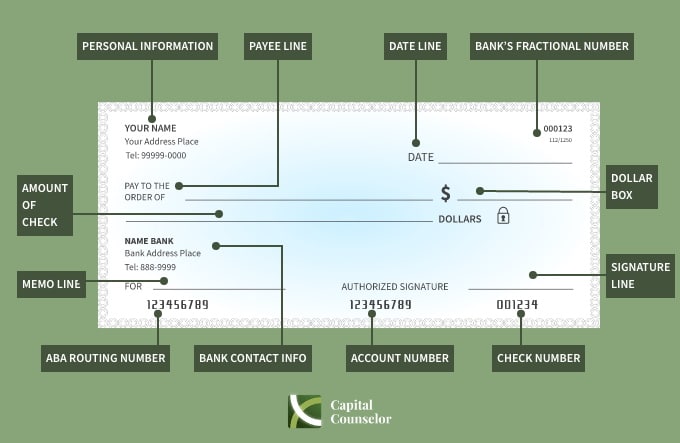

So, what can you see on a check? Here, we’ll explain the different check parts. Take a look at the image below:

Personal Information

In the upper left corner of the check, there should be the payor’s personal information. This usually includes their name, home address, city, state, and postal code. Sometimes, it may also include a phone number.

This is the person from whose account the money will be withdrawn. This also means that if you need to contact the person who gave you a check, this part should have all the necessary contact information.

Payee Line

On the payee line — line next to “pay to the order of” — you can see who is supposed to receive the check. So, if you’re the one to whom the check is given, you’d be the payee, and these would be your check details.

This part should include your name or the name of your business.

Sometimes, you may see a check written with “Cash,” which means that anybody can deposit or cash it.

The Dollar Box

Inside this box, you can see the value of the check written in numbers. However, if this number doesn’t match the one written in letters, you will get the amount that is written in words.

So, this area is mostly for you to see the amount easily and quickly, but it’s always a good idea to make sure it matches the amount written in letters. So, pay attention to the parts of a check labeled by $ and “dollars.”

The Amount

This is the amount that you would get — it is the official amount reflecting how much money you are legally entitled to. Of course, you will only get this money if the writer of the check actually has that amount in their bank account.

Also, keep in mind that you’d still be writing the cents in the number format. So, for example, if you want to give somebody $20.50, you’d write “Twenty dollars and 50/100.”

If there is any room left on the line after you write the amount, you may strike through that remaining space. This way, the recipient of the check would not be able to adjust the amount.

All in all, this is one of the parts of a check you should pay extra attention to when writing and reading.

Memo Line

This line is optional, but it can help you keep track of your payments. Here, you’d write the reason for the payment. So, for example, it can be your rent, paycheck, specific purchase, personal loan, etc.

Date Line

On the date line, you’d write the date of writing the check. However, sometimes, the payor may put a future date as a sign that it should be cashed later. Usually, it’s done when they don’t have enough funds in their account at that moment, but they will by the date they marked.

Either way, if you look at the picture of a check, you should see the date near the top-right corner.

Moreover, the check is still valid from the moment it’s signed, so the payee doesn’t have to wait. Still, if they try to do it before that date and it bounces, both the payee and the account owner could be charged a fee from the bank.

Also, while banks can let you cash checks older than six months, they don’t legally have to.

Signature Line

If you look at the image of a check, you’d see this line on the bottom right. This is where the issuer of the check should sign their name to make it valid. Without it, the check cannot be deposited.

You may receive a check with “No Signature Required” written on the signature line, but this usually means that the payment has been approved in some other way, and the check is simply a confirmation. Of course, if you don’t recognize the payment, contact your bank.

Bank Information

This tells you the name of the check issuer’s bank, and where your money will come from. If you have any questions about the check, this is the bank you’d call.

To cash the check, you’d need to visit a local branch of that bank. You may be able to deposit it in your own bank, but they might pay you only a portion of the amount.

Bank’s ABA Routing Number

This nine-digit number is located in the bottom-left part of the check.

The routing number on a check is like a bank address but in numbers — every bank has its specific routing number. This number is used for electronic transactions, like direct deposits, bill payments, digital checks, etc.

Some banks may have more than one routing number, depending on their size. So, if your bank is larger, make sure to use the right number.

Bank’s Fractional Number

This number can usually be found in the top right of the check. The numbers here correspond with your bank information. However, as they can be found elsewhere on the check, the fractional numbers are no longer used as often.

The Account Number

This is the number of the account from which the funds will be drawn. You can find it in the group of check numbers on the bottom — it is the second set of numbers next to the routing number.

This number is necessary if you want to set up any electronic payment, but otherwise, it’s used by the bank to process payments.

The Check Number

You can find this number at the bottom right. It identifies that individual check. Its purpose is to help you keep track of your checks and reduce confusion, as the ABA and account numbers can sometimes be the same.

Keep in mind that low numbers imply that the account is new, so it might be a good idea to make sure the check is valid, especially since you can choose your starting check number, and most of them start from 1000 to make their account look less suspicious.

Back of a Check

The person who cashes or deposits a check (the payee) will usually put their signature on the back. This is also known as “endorsing” a check, and it shows the bank that you are authorized to receive the amount written on the check.

Banks might also stamp their information in the back once the payment has been processed.

Conclusion

As you can see, reading a check is fairly simple once you understand what different numbers mean. So, if an opportunity ever comes for you to read a check, write one, or just help somebody else with it, we hope this article will come in handy.

FAQ

How do I read my bank account number on a check?

Along the bottom of your check, you will see two groups of numbers (sometimes three if your check number is in the bottom right corner). The first group refers to your routing number, and the second one is your account number.

What is the routing number on a check?

The routing number serves to track the transaction. It has nine digits, and it is like a numerical “address” of your bank — it shows through which bank the money will be withdrawn.

What info is on a check?

A check contains a lot of information, from your personal address to your account number. If you want to give somebody else that information, all you need to do is give them a voided check.

This is why knowing how to read a check is still important today, regardless of which means of transaction you prefer.