A soft inquiry does not affect your credit score. Lending or financial institutions, companies, employers, or landlords will make a soft inquiry if they want to check a person’s credit history or perform a background check.

Let’s take a closer look at what is a soft credit inquiry and how to make one.

What is a Soft Inquiry?

A soft inquiry, also known as a soft credit check or soft credit pull, is a credit inquiry that has no impact on your credit score. This inquiry type is mainly used for preapproval financing offers or background investigations.

If someone makes a soft inquiry on your credit score, this action won’t appear on your credit report. The only time that a soft inquiry will be visible is upon the consumer’s request or disclosure.

Here are examples of soft inquiries:

- Personal credit checks

- Pre-approved credit offers

- Insurance applications

- Account reviews by current creditors

- Employment background checks

Read on to find out how to make a soft inquiry.

How to Make a Soft Inquiry?

Here are some of the different ways you can do a soft credit check:

- Free annual reports – All United States residents can avail of one free credit report every 12 months from each of the three credit bureaus – Experian, Equifax, and TransUnion. You can also get a free credit report at AnnualCreditReport.com.

- Credit Report Card – You can request a Credit Report Card at Credit.com. The report will include your Experian credit report and Experian VantageScore 3.0 credit score. This report card is regularly updated every 14 days.

- Paid reports – If you have already used your free credit report, you can always pay credit bureaus for another credit report.

On an important note, if you want to access another person’s credit report, you will need a valid reason and authorization for the soft credit inquiry.

FAQs

How Long Do Soft Inquiries Stay On Your Credit Report?

Soft inquiries can stay on your credit report for up to two years. You should remember that they’re only visible to you. Your lenders won’t be able to see them.

What is an Experian VantageScore 3.0 Credit Score?

Experian VantageScore 3.0 is an alternative credit score model to FICO. It gives lenders a superior predictive credit risk score to make more effective and consistent risk-management decisions.

What is a Hard Credit Inquiry?

A hard credit inquiry usually occurs when you apply for a new loan or a credit card. A hard inquiry could impact your credit score and stay on your credit report for two years.

Bottom Line

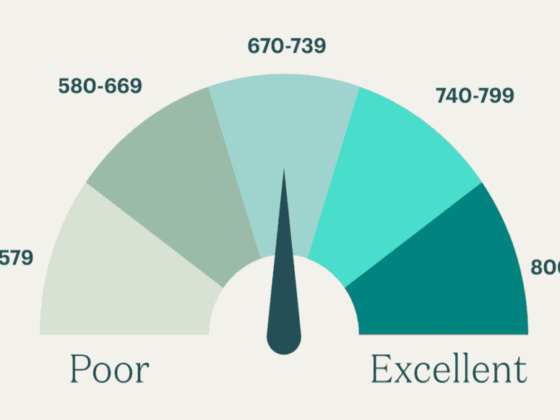

Your credit scores play a significant role in your financial life. Being vigilant and responsible in monitoring your credit report is advised to avoid negative impacts that could pull down your ratings. Regularly monitoring your credit report by making a soft inquiry could help you strategize how to strengthen or increase your credit score.