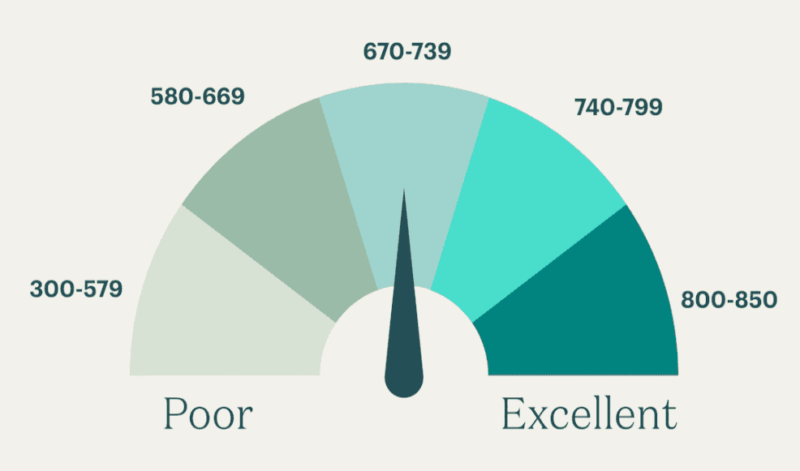

In general, a credit score under 600 is not ideal. It is considered fair or subprime based on the FICO®.

This raises the question; is 580 a good credit score? Continue reading this article to find out important insights on:

- whether 580 is a good credit score or not

- what this credits score can get you;

- how your credit score is computed; and

- how you can improve your credit score.

Let’s take a closer look.

Is 580 a good credit score or not?

You might encounter difficulties applying for loans and have higher interest rates with a score of 580. It’s also possible that your car insurance premiums will be more expensive.

Some lenders might also see your credit score as unfavorable and decline your credit application.

Fortunately, some lenders specialize in subprime lending that would accept your credit score. Still, you should consider it carefully before dealing with them because they charge relatively higher fees and interest.

Every creditor or lender has a different approach to computing and interpreting credit scores. Let’s proceed to the next section to learn what loans you can get for having a credit score of 580.

Overall, each creditor or lender takes a unique approach to calculating and interpreting credit scores. Let’s move to the next section to find out what loans you can get with a credit score of 580.

What can a Credit Score of 580 Get You?

The following are the financial services you can avail of with a 580 credit score:

Cash Loans

You may only qualify for smaller loan amounts with higher interest rates and shorter payment terms if your credit score is 580.

That said, the amount of money you can borrow will also depend on other factors like the loan you applied for, your income, your employment status, and even the creditor.

Home Loans or Mortgage

The best chance for a home loan with your credit score will be one insured by the Federal Housing Administration. Most FHA lenders, however, would require a 3.5% down since it’s less risky for them.

Private lenders may also provide “non-qualified mortgage” (non-QM) programs with easier requirements. Although these programs may permit credit scores as low as 500, non-QM loans often have higher interest rates than conforming and government-backed loans.

Car Loans

You can get a subprime car loan with a credit score of 580. Subprime loans are risky to take on and expensive. It will cost you more in interest than a standard auto loan.

For example, your new car loan can have an average annual percentage rate of around 10.79% or lower for a new car and 17.46% or lower for a used car.

You can use an online car loan calculator to understand how your current credit score can impact the computation of payments and interest.

Now we’re done with what a 580 credit score can get you. Read more to learn about how your credit score is computed.

How is Your Credit Score Computed?

Your credit score is determined based on the compiled credit reports by credit bureaus. Here are the most common criteria for computing your credit score:

Payment History

The most significant factor in your credit score is your payment history. It shows whether or not you are reliable when making loan and credit card payments. A late payment of 30 days can stay on your credit history for years, which can decrease your overall rating.

Credit Utilization

The amount of available credit is also a factor in determining a credit score. To maintain a good standing, experts recommend keeping your monthly credit utilization below 6% and never exceeding 30%.

If you want to know your current utilization ratio, the easiest way is to use credit utilization calculators.

Credit Age

Credit age refers to when you have had the credit accounts opened and how recently you’ve used an account. The longer you’ve had credit and the higher the average age of your accounts, the better your score.

Credit Mix

Credit mix means having different credit accounts, such as credit cards, auto loans, and mortgages. However, having a wide range of accounts plays a small role in determining your credit scores.

Having a credit score of 580 comes with many limitations and compromises. Continue reading to learn more about improving your credit score.

How to Improve Your 580 Credit Score?

You can do several quick, easy things if you’d like to raise your 580 credit score. While it might take a few months before you notice an improvement, here are things you can do to start improving it right away:

1. Pay Your Bills on Time

Always pay your bills on time, no matter what kind of bill. Even when you are disputing a bill, complete all payments to avoid the negative effects of late payments on your credit score. Setting up an automatic bill payment will help you make on-time payments.

2. Increase Your Credit Limit

Call and ask for a credit increase if you have a good credit standing. If you are granted an increase and maintain your spending habits, your credit utilization ratio lowers. And with on-time payments, you could boost your credit score.

3. Avoid Closing Your Credit Card Account

Even when you are not using them, credit experts disapprove of credit card account cancellation, especially if it is in good standing. Closing a credit account with a high credit limit and lengthy credit history can hurt your score.

4. Work With a Credit Repair Company

You can seek the help of a credit counseling or repair company to negotiate with your creditor and the three credit agencies to improve your credit score for a monthly fee.

5. Limit Opening New Credit Accounts

Lenders often view this as a warning sign if you create multiple new credit card accounts or take out new loans in a short time. Opening new accounts in a short period can mean accumulating too much debt and can’t be trusted to pay it back.

Take Away

Everyone’s financial and credit situation is unique. A credit of 580 might not be the best credit score out there, but it’s good enough. Pay your bills on time and take loans responsibly; you’ll have a higher score sooner than you think.

And because lenders use different methods to get your credit score, they fluctuate frequently. It would be better not to stress too much about getting an 850 score.

Frequently Asked Questions:

1. How do I get a credit score of 850?

Getting a credit score of 850 requires years of exceptional financial behavior, like maintaining a low credit use ratio, always paying on time, and keeping up a long history of credit accounts. In 2019, an Experian Study found that only 1.3% of Americans had a FICO score of 850.

2. Is it possible to live in America without a credit score?

You can live in America even if you don’t have a credit score. But it has its challenges. For one, you would need help with applying for mortgages, car loans, credit accounts, and other loans. A credit score can make finding an apartment or financing a car easier.

3. What websites provide free credit scores?

To get a free credit report, you can request for a free copy each year from the three major credit bureaus (TransUnion, Equifax, and Experian) by visiting AnnualCreditReport.com. You can also check your credit reports regularly on other websites that offer a free credit reports.