Do you want to make sure that your family is taken care of for generations to come? If so, you need to start thinking about generational wealth.

This is a term used to describe the accumulation of assets and income across multiple generations. It can be a challenge to achieve, but it is definitely worth it.

Want to know how to create it? Keep on reading.

What Is Generational Wealth?

Generational affluence is the concept of passing down money and assets from one generation to the next. Generational affluence can be in the form of cash, investments, property, or anything else of value.

The goal of generational affluence is to create financial stability and security for future generations.

For example, if you have a successful business, you may want to pass it down to your offspring.

Generational affluence can also be in the form of human capital, such as knowledge or skills that are passed down from one generation to the next.

Now that you understand the generational wealth definition let’s find out how to build it.

How to Build Generational Affluence

There are a few things you can do to start building generational affluence:

Invest in the Education of Your Children

Education is an important key to success, and by investing in your child’s education, you are setting them up for a bright future.

Start by talking to your kids about money and its value. You can also teach them about personal finance and saving, or you can do money-saving challenges together. This way, you will teach your children how to manage their finances effectively.

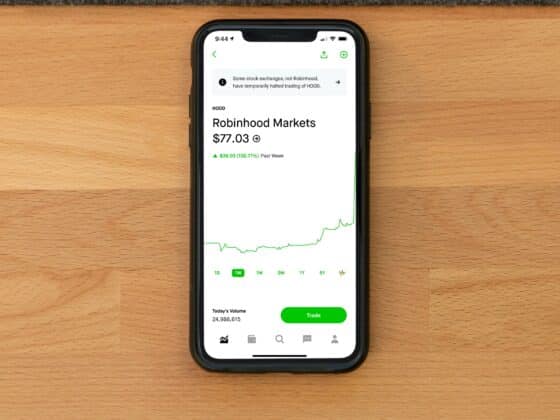

Invest in the Stock Market

Generational wealth building is all about creating long-term stability and security for future generations. And one of the best ways to do this is by investing in the stock market.

Of course, there are risks involved with investing in stocks. But if you diversify your portfolio and invest for the long term, you can minimize these risks.

Start Your Own Business

Did you know that 30% of family-owned enterprises pass down the torch to the next generation? 12% of these businesses are passed down into the third generation, and 3% make it through the fourth generation.

Examples of generational wealth businesses include restaurants, retail stores, farms, and manufacturing businesses.

The most famous people who inherited the family business are Alice Walton, the daughter of Walmart’s founder Sam Walton, and Charles and David Koch, who inherited their father’s oil business.

However, you don’t have to be a world-famous entrepreneur to pass down a successful business.

If you have a successful small business, you can pass it down to your children or grandchildren. And they can continue to grow the business and create even more wealth for future generations.

On the other hand, if your children are unwilling or unable to run the family business, you may still make money by selling it.

Invest in Real Estate

Real estate is often overlooked. Yet, it can be a great way to create long-term intergenerational wealth for future generations. For example, you can buy a rental property and rent it out.

Not only will this provide you with a steady stream of income, but it will also increase in value over time. And when you’re ready to retire, you can sell the property and pass down the proceeds to your offspring.

Make the Most of Life Insurance

Life insurance is another great way to create generational wealth. For example, you can take out a life insurance policy and name your children or grandchildren as the beneficiaries.

Not only will this provide them with financial security in the event of your death, but it will also give them a head start on their own financial future.

Why Is Generational Affluence Important

Firstly, it can provide financial security for your family. If you have assets and income that can be passed down, your family will always have something to fall back on.

Secondly, it can promote economic growth. When money is passed down from one generation to another, it helps to stimulate the economy and create jobs.

Thirdly, building generational wealth can help to preserve your family’s legacy. It can be used to fund philanthropic causes or to start a family business that can be passed down for generations.

Lastly, it can provide you with a sense of satisfaction and accomplishment. Knowing that you have built something that will last long after you are gone can be a great source of pride.

What’s the Value of Generational Affluence?

According to the Federal Reserve, the average value of generational money amounts to $350 billion per year.

Most of this money is being passed on through inheritance rather than other means, such as gifts or loans. In fact, 21% of millionaires inherited their wealth.

When it comes to generations, Baby Boomers hold the most US wealth, which is valued at $71.08 trillion, or almost twice as much as Generation X’s $42.16 trillion. The generational wealth gap is even higher when it comes to Millennials. They hold only $9.38 trillion.

Can Generational Affluence Last Forever?

Generational affluence is not forever. Based on estimations, by the second generation, 70% of affluent families will no longer be wealthy, and 90% of families will lose their wealth by the third generation.

Several factors can contribute to this:

- Children are advised not to talk about money to avoid having their parents’ comments and attitudes influence how they think about money.

- Older generations believe the next generation will grow lazy and entitled.

- Many people are ignorant of the importance of money or how to manage it.

There are, however, exceptions. For example, one of the most famous generational wealth families, the Rockefellers, managed to maintain their wealth for seven generations.

Conclusion

Generational affluence is a topic that is often overlooked, but it is important to consider if you want to build long-term wealth for your family. There are many ways to do this, such as investing in real estate or taking out a life insurance policy.

While it is not easy to maintain, it can be very rewarding and provide financial security for your family for generations to come.

FAQs

What amount is generational wealth?

The average value of generational affluence, as determined by the Federal Reserve, is $350 billion per year. However, there is no agreed-upon figure that defines it, and it depends on how you measure it.

How many generations does generational wealth last?

There is no definitive answer, as it depends on several factors. However, most experts agree that it generally lasts for two to three generations. After that, the chances of it being passed down diminish significantly.

Do I have generational wealth?

If you have assets or income that can be passed down to future generations, then it’s likely that you have some form of generational affluence.

However, it’s important to note that not all wealth is created equal. In order to be considered generational wealth, it must be sustainable and have the potential to grow over time.